Ubs wealth management commodity director and chief investment officer’s Asia director of foreign exchange Dominic Schnider (Dominic Schnider at ubs) said that from the point of supply, a variety of base metals in the second half of the year when the demand is expected to be stronger degree of benefit is not balanced. In this respect, aluminium, nickel and zinc prices rise this year is expected to more than 10%. We expect these metals will be small in short supply situation.

Besides China, supply aluminium market this year is expected to reach nearly 600000 tons, equivalent to the global (excluding China) (the same below), 2.5% of the total demand to a one-off boost prices. China to increase domestic supply surplus aluminium exports to international markets, has the potential to be binding agent rally. This may result in aluminum prices will only briefly rose above $2000 / ton.

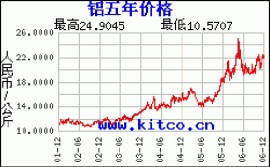

For nickel ore export ban from Indonesia nickel ore in short supply, and high-quality ore inventory is about to run out of China, the clay mineral (nickel pig iron) production, higher risk means there is a shortage of supply of nickel market this year. Gap is expected to reach 600000 to 600000 tons, equivalent to 3.3% of the total annual demand. Nonetheless, plenty of stock exchanges may make up the supply gap, thus making nickel prices will only temporarily to above $20000 a tonne.

For zinc, the main mining companies shut down and a decline in production can lead to supply 380000 tons, indicate a bright future of zinc. However, plans to increase production. This means that the zinc market within actual supply gap may be down to 200000 tons, equivalent to 1.4% of the total annual demand. We expect 2015 zinc prices are expected to rise to $2400 / ton.

The prospect of the copper is not optimistic, the reason is that at least 200000 tons of potential market oversupply, equivalent to 0.8% of the total annual demand. Theoretically, copper supply appears solid, net this year between 1 million and 1.2 million tons of ore production. Considering the demand weakness, during the first half of 2015 annual global new copper demand may be lower than our forecast of 80-80 tons. Thus, while copper prices are likely to hit bottom in the second quarter of this year, but the upside is still in doubt.