In the just concluded world economic BBS annual meeting of the new champions in 2015, the world’s largest aluminium producer Russia aluminum (party, hereinafter referred to as “aluminum”), vice President of oleg mocha MaiDeShen to accept an interview, for emerging markets “devaluation tide” published their own views. “The rouble devaluation is a” double-edged sword “, its despite the blow to the foreign direct investment motivation, but also help Russia partly offset by financial pressures brought by the commodity prices fell.”

Mocha MaiDeShen said currencies have depreciated, depreciation understandable, and prices fell and the economic downturn has little to do in China. Because of China’s aluminium alloy underground cable, introduced the latest approval, aluminum on lightweight cars get used worldwide, these reasons are the support from all walks of life demand for aluminum. Prices is mainly due to the global excess capacity. Instead of crude oil, coal, copper prices will be influenced by demand from China in the first place.

The recent Russian aluminum, according to results released in the first half of the profit, income increased 8.3% to $4.75 billion, about $879 million of profit, earnings per share of $0.0579, not dividends. The losses of about $209 million over the same period last year.

A devaluation is a “double-edged sword”

Mocha MaiDeShen is introduced, the Russian aluminium in recent years a large number of cuts in excess capacity, and the rouble devaluation also alleviate the financial pressure of the company.

Specifically, the negative effects of the ruble mainly lies in the mood for domestic consumption and investment in Russian. Russia’s modern economic development, a researcher at mas aleynikov, points out that the rouble devaluation will eventually be passed on to the consumer prices, lead to serious domestic inflation. In September last year, according to data and the rouble crisis during the Russian inflation since the rupee rose to 8%, food prices rose 11.4% during the month. Imported goods, such as notebook sales slump. Many russians also postponed plans to buy cars and other big-ticket items.

In addition, mocha MaiDeShen also told reporters: “the Russian company still sanctions by the western countries, so more difficult to get foreign capital, whether debt or equity financing, it also makes the capital use cost rise.”

Of course, the so-called “double-edged sword” cannot ignore its positive side. Mocha MaiDeShen pointed out that, as a result of international commodities market settlement with the U.S. dollar, and Russia’s fiscal revenue is using the rouble. So even if the drop of oil or other commodities, through the rouble devaluation can ensure Russian oil exports rouble revenues basically remain unchanged.

“Devaluation and sanctions also bring opportunities for Russia’s domestic industries, such as agriculture, industrial goods reduction can enlarge the supply of domestic producers, promoting the development of domestic.” Mocha MaiDeShen said.

In addition, when it comes to depreciation sparked controversy, mocha MaiDeShen also agree with the move. “Look to emerging market countries, many are falling in value, in order to ensure that the value of the yuan conforms to the economic fundamentals, as well as China’s export advantage, moderate devaluation is reasonable.”

China had a little effects on prices

In addition to the currency, the recent international thering is no lack of a sound – the renminbi devaluation, China’s economy slows, reduce the global demand for commodities, for aluminum really?

Mocha MaiDeShen believes that the current aluminum prices fall has nothing to do with China’s economic slowdown, but caused by excess supply.

In his view, aluminum and other commodities is a bit different. Oil prices have a “ks” in July last year, the price of iron ore prices plunged nearly 50% in 2014, and since 2015, fell by more than 30%.

“But the domestic and foreign demand for aluminium is still relatively strong. For example, China’s consumer demand growth above 10%, while demand growth of 4% in the United States, Europe increased by more than 2%.”

Mocha MaiDeShen, according to the current aluminum car’s popularity, mainly thanks to its lightweight and flexible properties. In addition, aluminum alloy also be used in underground cable. “After China do not allow the production of aluminum alloy underground cables, are allowed to produce in September, has been driven by a demand for aluminium. In contrast, the original copper cable is three times that of aluminum, but both has no big difference, the aluminum alloy in this aspect will be even greater demand.”

About how to solve the excess supply, mocha MaiDeShen said in an interview with the media, all aluminum producers should to portfolio, “not profitable outdated production capacity should be closed.” Aluminum has closed down nearly 700000 tons of inefficient not electrolytic aluminum production capacity, environmental protection and plans to close 200000 tons of production capacity in the future.

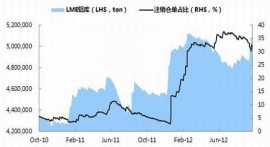

According to Chinese nonferrous metal association aluminum branch report, in 2015 China’s aluminium production capacity will increase by 5 million tonnes. In 2014 the global output of about 53.9 million tons of aluminium, consumption of about 54.85 million tons.